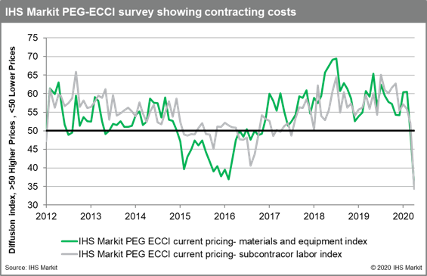

據(jù)IHS Markit調(diào)查公司(NYSE:INFO)采購(gòu)執(zhí)行小組(PEG)數(shù)據(jù),被調(diào)查者均認(rèn)為工程造價(jià)的下滑壓力將持續(xù)整個(gè)秋季,導(dǎo)致行業(yè)對(duì)造價(jià)的未來(lái)預(yù)期達(dá)到歷史新低。

經(jīng)過(guò)連續(xù)41個(gè)月的增長(zhǎng)后,建筑工程造價(jià)在今年4月份首次出現(xiàn)了下跌,繼3月份勉強(qiáng)位于基準(zhǔn)指數(shù)后,4月份的造價(jià)指數(shù)為34.9,建筑材料和設(shè)備造價(jià)指數(shù)為35.2,分包商造價(jià)指數(shù)為34.3,均位于50的基準(zhǔn)指數(shù)之下。

建筑材料和設(shè)備價(jià)格指數(shù)為35.2,不僅顯示著該數(shù)值連續(xù)兩個(gè)月的下跌,也表示該數(shù)值達(dá)到了歷史新低。調(diào)查顯示,與3月份相比,在建筑材料和設(shè)備12個(gè)分項(xiàng)中,除預(yù)制混凝土價(jià)格處于基準(zhǔn)指數(shù)外,其余11項(xiàng)價(jià)格均有下跌。在建筑設(shè)備中,除轉(zhuǎn)換機(jī)外,其余設(shè)備的價(jià)格均從3月份的上漲變成了4月份的下跌。結(jié)構(gòu)鋼、合金鋼管、碳鋼管等材料的價(jià)格更是達(dá)到了自2012年指數(shù)調(diào)查開(kāi)始以來(lái)的最低。而目前調(diào)查顯示的結(jié)果只表明4月份價(jià)格下跌,并不能確定價(jià)格不會(huì)繼續(xù)探底。

“建筑工程造價(jià)指數(shù)的快速下滑反映出美國(guó)經(jīng)濟(jì)的快速衰退,尤其是自1月份以來(lái)能源行業(yè)的衰退”,HIS Markit公司價(jià)格和采購(gòu)調(diào)研主管約翰·馬瑟索爾說(shuō),“HIS Markit公司并不認(rèn)為二季度的油價(jià)已經(jīng)探底,這表明,美國(guó)經(jīng)濟(jì)的復(fù)蘇將會(huì)是一個(gè)漫長(zhǎng)的過(guò)程,將持續(xù)到2021年”。

分包商的人力成本指數(shù)3月份為52.0,4月份降為34.3。與材料和設(shè)備相同,美國(guó)和加拿大的人力成本也均達(dá)到了自2012年指數(shù)調(diào)查開(kāi)始以來(lái)的最低。

在經(jīng)過(guò)連續(xù)43個(gè)月的增長(zhǎng)后,建筑工程造價(jià)半年總體預(yù)期指數(shù)于今年4月份首次下降,位于42.1,IHS Markit調(diào)查公司PEG小組進(jìn)行此項(xiàng)調(diào)查追蹤后的又一新低。建筑材料、設(shè)備和人力預(yù)期價(jià)格均下跌。3月份,材料和設(shè)備的半年預(yù)期指數(shù)為57.6,4月份降為了40.7,其它所有分項(xiàng)的半年預(yù)期價(jià)格指數(shù)也均下降。4月份的人力成本預(yù)期指數(shù)為45.2,美國(guó)中西部地區(qū)的人力成本價(jià)格有望在接下來(lái)的6個(gè)月內(nèi)有所增長(zhǎng),西部地區(qū)仍舊不景氣,走勢(shì)平平,而在加拿大、美國(guó)南部和東南部,人力成本價(jià)格將繼續(xù)下跌。

調(diào)查還發(fā)現(xiàn),受新冠肺炎影響,建筑市場(chǎng)需求有所縮減。(翻譯:中國(guó)建筑業(yè)協(xié)會(huì))

COVID-19 Impact Sends Engineering and Construction Costs Negative for First Time Since November 2016, IHS Markit Says

文章來(lái)源:IHS Markit 網(wǎng)站,Expectations for future construction costs reached all time low as respondents see negative cost pressures continuing through fall

April 29, 2020

NEW YORK (April 29, 2020) – After 41 consecutive monthly increases, Engineering and Construction costs fell in April, according to IHS Markit (NYSE: INFO) and the Procurement Executives Group (PEG). The current headline IHS Markit PEG Engineering and Construction Cost Index registered 34.9 in April, after staying barely neutral in March. The materials and equipment portion of the index came in at 35.2 and the sub-contractor portion came in at 34.3; any figure below 50 indicates falling prices.

The materials and equipment sub-index registered 35.2, recording both the second consecutive month of falling prices and an all-time low. Survey respondents reported falling prices for 11 out of the 12 components with only ready-mix prices coming in at neutral. Index figures for all categories dropped relative to March, indicating that a greater proportion of the respondents are observing lower prices. With the exception of exchangers, all equipment categories moved from increasing prices in March to falling prices in April. For categories such as fabricated steel, alloy steel pipe and carbon steel pipe, April’s diffusion index reading was the lowest since the survey started in 2012. This does not mean that respondents saw the lowest prices in April, merely that most companies surveyed observed falling prices.

“The sharp decline recorded in the index highlights the rapid deterioration in the U.S. economy and, more specifically, in the energy industry since January,” said John Mothersole, director of research at IHS Markit pricing and purchasing. “IHS Markit does see a bottom for oil prices in the second quarter. This said, the recovery in the U.S. economy looks to be sluggish and extend well into 2021.”

The sub-index for current subcontractor labor costs came in at 34.3 in April. Responders had noted rising prices in March, with an index figure of 52.0. Labor costs fell in all regions of the United States as well as Canada. Similar to materials and equipment sub-index, this was the lowest ever reading since the survey started in 2012.

After 43 months of consecutive increases, the six-month headline expectations for future construction costs fell in April with an index figure of 42.1, yet another all-time low for the IHS Markit PEG Engineering and Construction Cost Index. Both the materials/equipment and labor subcomponents recorded expectations of future price decreases. The six-month materials and equipment expectations index came in at 40.7 this month, down from 57.6 last month, with responders expecting falling prices for all categories. Expectations for sub-contractor labor slipped to 45.2 in April. While the U.S. Midwest is expected to see higher labor costs in six months, labor costs are expected to stay flat in the U.S. West. Labor costs in Canada, U.S. South and U.S. Northeast are expected to keep falling.

In the survey comments, respondents noted lower demand conditions due to the novel coronavirus (COVID-19).